Starting in 2026, the EU will enforce carbon taxation, meaning CBAM reporting is no longer voluntary. Companies must submit periodic reports containing detailed emission calculations, prepared using methodologies recognized by the EU and verified by competent bodies. Failure to comply may result in higher carbon levies or even risks in market access.

In reality, many Vietnamese businesses—particularly in steel, cement, aluminum, fertilizers, and chemicals—are still navigating a maze of data requirements, emission standards, calculation methods, and the selection of appropriate emission factors. Numerous enterprises have collected data but are unable to convert it into EU-compliant CBAM reports, while others remain uncertain about allocating emissions to individual exported products. This is precisely the gap KLINOVA aims to fill through its “CBAM Practical Training” program.

The course is designed for participants who need clarity, hands-on practice, and the ability to implement immediately after training. Rather than presenting theories alone, the program emphasizes understanding core emission calculation methodologies, standardizing data, identifying common reporting issues, and applying international practices such as ISO 14064, ISO 14067, the GHG Protocol, and IPCC guidelines. Learners will work directly with the official CBAM reporting templates required by the EU, understand how each data field operates, select the correct CN codes, and apply calculation methods for both simple and complex products.

A key strength of the program lies in its practical and applicable nature. KLINOVA’s team of experts—professionals with extensive experience in GHG inventory, emission accounting, compliance advisory, and international standards—will accompany participants throughout the two-day training. Learners will not only receive explanations but also be guided step-by-step through handling missing data, allocating materials and fuels across production stages, applying default values where appropriate, and evaluating data quality before finalizing their report. By the end of the course, each participant will have completed a CBAM report using a sample dataset, with expert feedback to ensure alignment with EU expectations.

The training will take place in person at the University of Economics Ho Chi Minh City (UEH) on January 08 and 09, 2026. This is an opportunity for businesses to comprehensively update themselves on the latest CBAM requirements, standardize internal reporting processes, and strengthen their competitiveness in the European market as carbon taxation becomes increasingly stringent. Early preparation not only helps reduce compliance risks but also supports long-term sustainability strategies and alignment with global supply chain requirements.

Interested businesses may register by scanning the QR code on the poster or contacting KLINOVA for further assistance. Now is the critical moment to take action and equip your organization with the right knowledge before the EU fully enforces its carbon taxation mechanism.

Meeting to propose the implementation of the Letter of Intent for the National Green Carbon Action Partnership Program (NBCAP)

Meeting to propose the implementation of the Letter of Intent for the National Green Carbon Action Partnership Program (NBCAP)

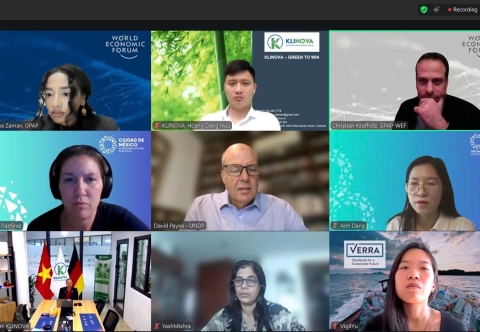

Online Workshop on the Financing Roadmap for Plastic Action to 2030: Mobilizing USD 8.5 Billion for Viet Nam’s Circular Economy

Online Workshop on the Financing Roadmap for Plastic Action to 2030: Mobilizing USD 8.5 Billion for Viet Nam’s Circular Economy