The workshop marked the first activity in the implementation of the technical assistance package, aiming to introduce the project’s objectives, scope, and implementation plan, while providing a platform for the exchange of international experience and practical insights from Viet Nam in the areas of green finance and green banking. In their opening remarks, representatives of the State Bank of Viet Nam, ADB, and the Embassy of Japan in Viet Nam emphasized the critical role of the banking system in managing climate risks, mobilizing financial resources for the green transition, and supporting Viet Nam’s climate commitments.

Within the program, ADB representatives presented an overview of the technical assistance project, outlining its components, key activities, and implementation arrangements in the period ahead. The project focuses on supporting the State Bank of Viet Nam and relevant stakeholders in strengthening institutional capacity and improving policy frameworks and guidance on green banking, green finance, and sustainable finance, in line with international practices and the domestic context.

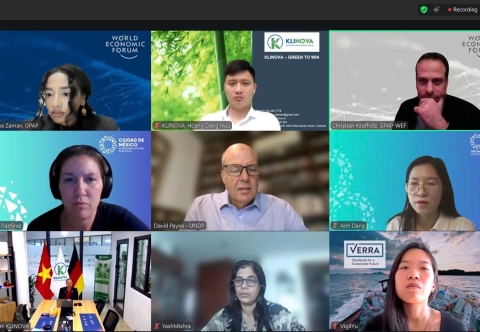

KLINOVA participates in the project as one of the key consulting firms, together with PwC, ERM, and SynTao Green Finance. At the workshop, KLINOVA experts Dr. Nguyen Phuong Nam, Mr. Marcus Hall, and Dr. Nguyen Thanh Hai directly delivered presentations and moderated thematic discussion sessions on the green banking policy framework, drawing on global trends and practical experience in Viet Nam.

The presentations and discussions led by KLINOVA experts focused on four key thematic areas: climate risk assessment in the banking sector; green bond issuance by credit institutions; macroeconomic impacts of carbon pricing mechanisms; and the role of credit institutions in the development of carbon markets. The analyses highlighted the linkages between climate risks, financial stability, and credit risk management, while underscoring the importance of policy frameworks, data availability, and institutional capacity in the transition toward green banking.

During the open discussion session, KLINOVA experts engaged with representatives from the State Bank of Viet Nam, the World Bank, as well as financial institutions and development partners to exchange views on the challenges and opportunities associated with integrating climate risks into banking supervisory frameworks, developing green financial instruments, and gradually participating in carbon markets. The discussions also emphasized the importance of designing a roadmap that is suited to Viet Nam’s conditions while progressively aligning with international standards and good practices.

Through the exchanges at the workshop, participants shared a common view that strengthening regulatory capacity, improving policy frameworks, and promoting the proactive role of the banking system are critical to advancing green finance and sustainable finance in Viet Nam. The inception workshop is expected to lay the groundwork for the effective implementation of the Green Banking Component in the coming period, contributing to the development of a green banking system and a sustainable financial market.

- Huu Hoang -

Launch of the Green Banking Component under the Technical Assistance Project on Expanding Inclusive and Climate Finance

Launch of the Green Banking Component under the Technical Assistance Project on Expanding Inclusive and Climate Finance

Meeting to propose the implementation of the Letter of Intent for the National Green Carbon Action Partnership Program (NBCAP)

Meeting to propose the implementation of the Letter of Intent for the National Green Carbon Action Partnership Program (NBCAP)

Online Workshop on the Financing Roadmap for Plastic Action to 2030: Mobilizing USD 8.5 Billion for Viet Nam’s Circular Economy

Online Workshop on the Financing Roadmap for Plastic Action to 2030: Mobilizing USD 8.5 Billion for Viet Nam’s Circular Economy